The graphs on this page offer some analytics of SBA loans approved under both the 7(a) guaranty and CDC/504 program that were identified as involving business owners who are identified by gender. These statistical results have been published by SBA back to the FY 2009, and SBFI will update these statistics with graphics annually.

SBFI did not distinguish as to whether the corresponding companies reported to be either <50% or >50% owned, as provided by the SBA, but rather reports the summary total provided by SBA reporting.

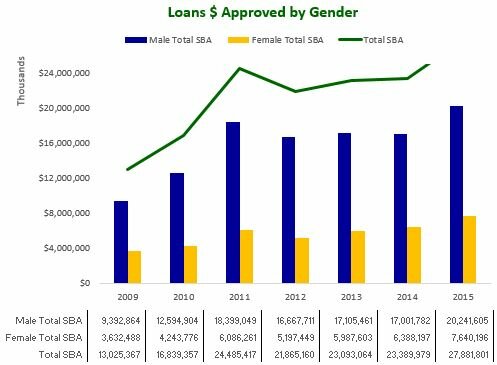

Loans $ Approved by Gender

The first graph illustrates the total $ volume of loans approved for males and females through the 7(a) and CDC/504 loan programs combined, with the total level of SBA program loans highlighted with the green line.

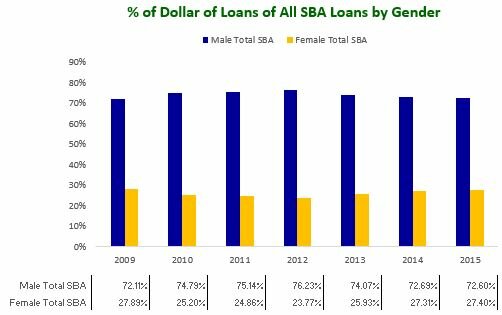

The second graph compares the total $ volume of loans approved for males and females as a percentage of total 7(a) loans and CDC/504 loans combined.

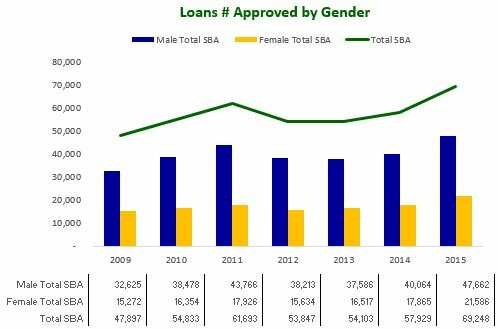

Number of Loans Approved by Gender

The third graph illustrates the total number of loans approved for males and females through the 7(a) and CDC/504 loan programs combined, with the total level of SBA program loans highlighted with the green line.

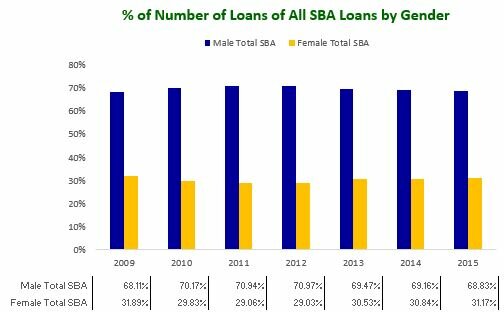

The fourth graph compares the total number of loans approved for males and females as a percentage of total 7(a) loans and CDC/504 loans combined.

Female entrepreneurs own more than seven million businesses in the U.S. (one out of every four) and employ more than 7.8 million workers. According to American Express, women entrepreneurship has been increasing about 45% faster than the pace of all small business growth in the U.S., between 1997 and 2014. Those companies account for aggregate annual revenues of more than $2.5 trillion.

SBFI tracks a range of business lending results and lender performance through published statistics and lender surveys. Finance programs facilitated by the U.S. Small Business Administration offer several financing assistance programs to small business concerns for a variety of purposes.

For more information, contact .