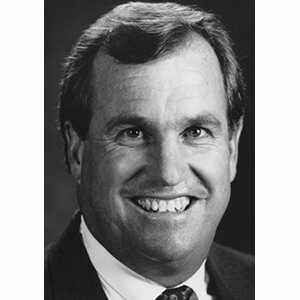

Chaka “Chip” Fattah Jr., the son of a veteran Philadelphia congressman, has been sentenced to five years in federal prison on charges of bank and tax fraud.

Fattah Jr., misused funds while serving as a school management subcontractor, and has  now been sentenced to five years in prison, another five years of supervised release, and ordered to pay $1,172,157 in restitution by U.S. District Court Judge Harvey Bartle III.

now been sentenced to five years in prison, another five years of supervised release, and ordered to pay $1,172,157 in restitution by U.S. District Court Judge Harvey Bartle III.

Fattah Jr., who served as his own attorney, believes that his father, Fattah Sr., was the target of his prosecution and the whole trial was a way of getting at him, as he said outside the courtroom last year, “This entire investigation has been politically motivated. If my dad wasn’t the congressman, nobody would be going after me. ”

Chaka Fattah Sr. is currently serving his 11th term in the House Appropriations Committee, having been in congress for close to two decades.

In delivering the sentence, Judge Harvey Bartle III described Fattah Jr. as someone who has enjoyed and misused so many privileges, saying he “had many opportunities and advantages that most young people could only dream about,” and made “bad choices of your own free will.”

In November 2015, a federal grand jury had found Fattah Jr. guilty on a 22-count charge of bank fraud; making false statements to banks to obtain loans; making false statements to banks and the Small Business Administration (SBA) to settle loans for less than what was owed; filing false federal income tax returns for tax years 2005, 2006 and 2008; failing to pay federal income tax; wire fraud; and theft from a program receiving federal funds.

Banks that were defrauded by his fraudulent loan applications included Citizens Bank ($26,000); PNC Bank ($30,000); Sun National Bank ($50,000); Bank of America ($10,000); Wachovia, now Wells Fargo ($25,000); United Bank ($50,000); Philadelphia Federal Credit Union ($15,000). He also provided false information to two banks and the Small Business Administration in order to settle some of those loans after he defaulted, according to evidence presented in court.

In all, prosecutors said Fattah Jr. used nearly $1 million in loan proceeds for his personal expenses and in settling gambling debts.

After the sentencing, Fattah Jr. still stood firm on his claim of innocence, “I didn’t know anything I did was a violation of the law,” he told the judge.

Fattah Sr. has also defended his son’s actions by saying “they’ve taken my only son, and I guess they suggested this was justice, I’ll leave it for others to decide.” In May, the long-serving congressman will also have his day in court where he, alongside others, are scheduled to stand trial on multiple counts of fraud before the same judge that has sentenced his son.

SBFI offers 40+ training courses to improve commercial lending skills-get catalog here.

Subscribe to AdviceOnLoan–award-winning, weekly newsletter for commercial lenders.

What do you think? Your comments are welcome or write .