The graphs on this page offer some analytics of the monthly approvals of the SBA loan guaranty programs to provide participating lenders with a deeper understanding of what’s behind the numbers published by SBA.

By tracking the monthly approved lending volumes, participants can assess real-time performance of the programs as an indicator of macroeconomic growth and program impact.

7(a) Loans $ Approved

The first graph tracks the $ loan volume each month between the current period and the same period during the previous two fiscal years for the SBA 7(a) loan program.

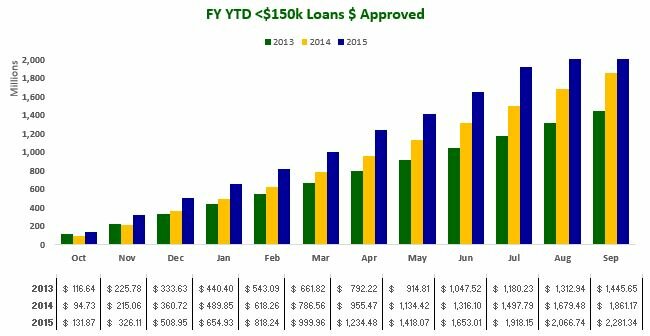

7(a) Loans <$150k $ Approved

The second graph tracks the $ loan volume each month between the current period and the same period during the previous two fiscal years for SBA 7(a) loans <$150k.

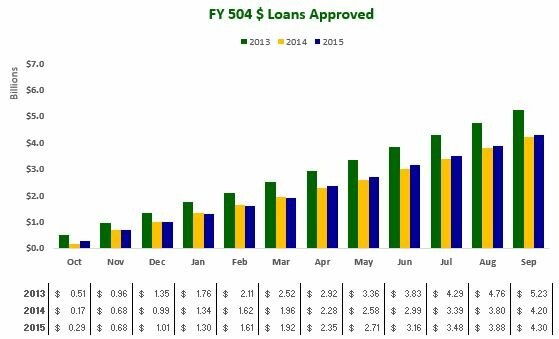

504 Loans $ Approved

The third graph compares the $ loan volume each month between the current period and the same period during the previous two fiscal years for the SBA CDC/504 loan program.

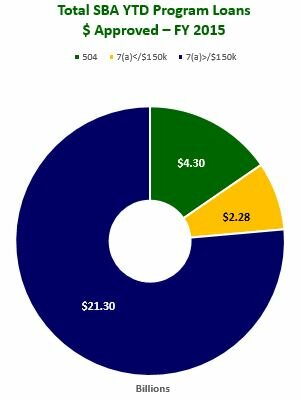

Total SBA YTD Program Loans $ Approved

The fourth graph illustrates the $ loan volume of each program as a portion of the YTD total SBA program $ volume, broken down between the 7(a) loans >$150k, 7(a) loans < $150k, and CDC/504 loans.

SBFI tracks a range of business lending results and lender performance through published statistics and lender surveys. Finance programs facilitated by the U.S. Small Business Administration offer a variety of financing to small business concerns for a variety of purposes. The agency publishes detailed lending activity regularly which is available at their site.

For more information contact .